Understanding Real Estate Market Cycles

Introduction

The real estate market is characterized by its cyclical nature, with distinct phases that impact property values, investment opportunities, and overall market conditions. Understanding these cycles is crucial for buyers, sellers, investors, and industry professionals to make informed decisions and optimize their strategies. This article delves into the key phases of real estate market cycles, factors influencing these cycles, and tips for navigating them effectively.

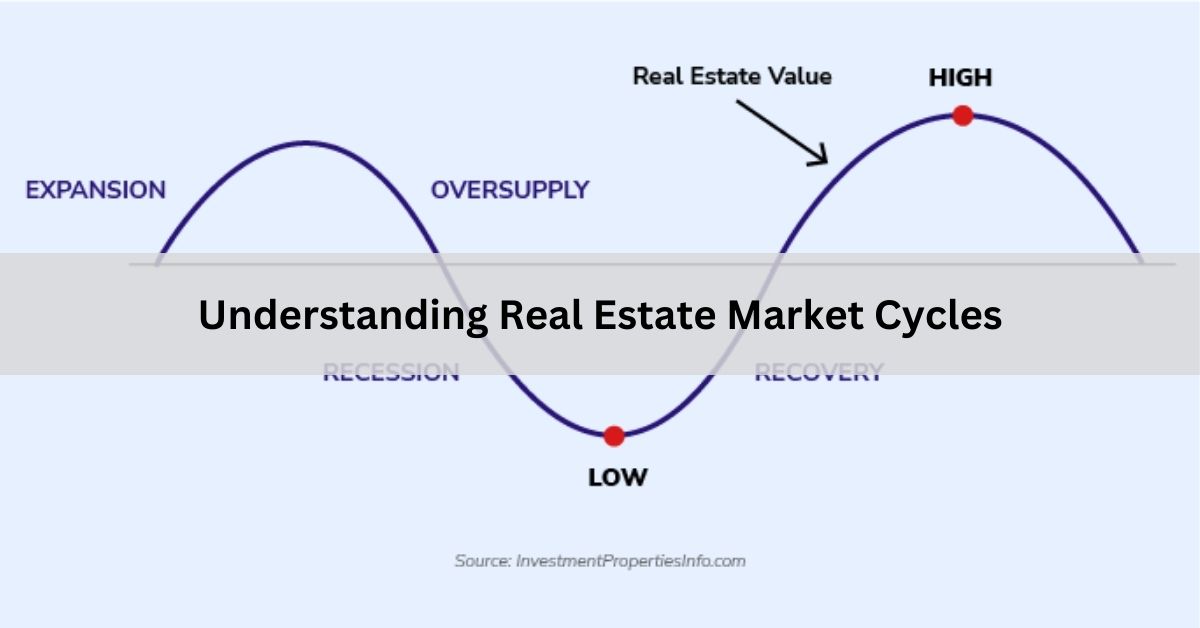

The Four Phases of Real Estate Market Cycles

Real estate market cycles typically consist of four phases: recovery, expansion, hyper supply, and recession. Each phase has unique characteristics and implications for market participants.

Recovery Phase

The recovery phase follows a market downturn or recession. During this phase, property values are often at their lowest, and market activity is subdued. However, signs of improvement begin to emerge, such as increased property transactions, stabilization of prices, and a gradual uptick in demand. Savvy investors often see the recovery phase as an opportunity to purchase properties at lower prices, anticipating future appreciation.

Expansion Phase

The expansion phase is marked by robust economic growth, increased employment, and rising consumer confidence. Property values and rental rates typically increase as demand for real estate surges. New construction projects become more prevalent, and developers aim to capitalize on the favorable market conditions. This phase presents opportunities for sellers to maximize returns and for buyers to invest in appreciating assets.

Hyper Supply Phase

The hyper supply phase occurs when the market becomes oversaturated with properties, often due to excessive new construction during the expansion phase. As supply exceeds demand, property values and rental rates may begin to stabilize or decline. Market participants need to exercise caution during this phase, as the risk of overpaying for properties increases. Investors should focus on properties with strong fundamentals and long-term value potential.

Recession Phase

The recession phase is characterized by declining property values, reduced market activity, and increased vacancies. Economic downturns, higher interest rates, and negative market sentiment can contribute to this phase. Sellers may struggle to find buyers, and investors should be cautious about acquiring new properties. However, the recession phase can also present opportunities for those with a long-term investment horizon and the ability to withstand short-term market fluctuations.

Factors Influencing Real Estate Market Cycles

Several factors contribute to the cyclical nature of the real estate market. Understanding these influences can help market participants anticipate changes and adjust their strategies accordingly.

Economic Indicators

Economic indicators, such as GDP growth, employment rates, and consumer spending, play a significant role in shaping real estate market cycles. Strong economic performance generally leads to increased demand for real estate, while economic downturns can trigger market contractions.

Interest Rates

Interest rates directly impact the cost of borrowing and, consequently, the affordability of real estate. Lower interest rates tend to stimulate demand by making mortgages more affordable, while higher interest rates can dampen demand and slow market activity.

Government Policies

Government policies, including tax incentives, zoning regulations, and housing programs, can influence real estate market cycles. For example, favorable tax policies may encourage investment, while stringent zoning regulations can limit new construction and affect supply dynamics.

Demographic Trends

Demographic trends, such as population growth, migration patterns, and household formation, affect demand for real estate. Areas experiencing population growth and urbanization are likely to see increased demand for housing and commercial properties.

Supply and Demand Dynamics

The balance between supply and demand is a fundamental driver of real estate market cycles. Periods of undersupply can lead to price increases and construction booms, while oversupply can result in price stabilization or declines.

Navigating Real Estate Market Cycles

Successfully navigating real estate market cycles requires a combination of market knowledge, strategic planning, and flexibility. Here are some tips for different market participants:

For Buyers

- Timing the Market: While it’s challenging to time the market perfectly, buyers can benefit from purchasing properties during the recovery or early expansion phases when prices are relatively low.

- Due Diligence: Conduct thorough research on market conditions, property values, and future growth prospects. Work with a knowledgeable real estate agent to identify opportunities.

- Financing: Secure favorable financing terms by monitoring interest rates and acting when rates are low. Pre-approval for a mortgage can strengthen your position in a competitive market.

For Sellers

- Market Timing: Sellers should aim to list their properties during the expansion phase when demand is high and prices are rising.

- Property Presentation: Enhance the appeal of your property through staging, repairs, and upgrades. Well-presented properties attract more buyers and higher offers.

- Pricing Strategy: Set a competitive price based on current market conditions and comparable sales. Avoid overpricing, which can lead to extended listing times and potential price reductions.

For Investors

- Diversification: Diversify your real estate portfolio across different property types and geographic locations to mitigate risk and capitalize on various market opportunities.

- Long-Term Focus: Adopt a long-term investment strategy that accounts for market cycles. Focus on properties with strong fundamentals and growth potential.

- Risk Management: Conduct thorough due diligence and assess potential risks. Consider working with a financial advisor or real estate expert to develop a comprehensive investment plan.

Conclusion

Understanding real estate market cycles is essential for making informed decisions and optimizing strategies in the real estate market. By recognizing the phases of recovery, expansion, hyper supply, and recession, and understanding the factors influencing these cycles, buyers, sellers, and investors can navigate the market more effectively. Whether you’re a first-time homebuyer, a seasoned investor, or a property seller, staying informed and adaptable will help you achieve your real estate goals.

You May Also Like

Orangîa – Exploring the Tropical Fruit’s Origins, Benefits, and Culinary Delights

July 14, 2024

Behavioral Economics in Insurance

July 11, 2024